Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

The China Central Meteorological Observatory continued to issue the highest-level high temperature red warning on August 22. Earlier, the National Climate Center of China said that the intensity of this round of heatwaves in China has hit the strongest level since records began in 1961.

China also issued its first nationwide drought warning of the year last week. The water level of the Yangtze River is currently at an all-time low. Parts of the Jialing River, the main tributary of the Yangtze River, rarely expose the riverbed.

China’s Ministry of Water Resources said that the water levels of the main stream of the Yangtze River and Dongting Lake and Poyang Lake were 4.85 to 6.13 meters lower than the same period of the previous year. The surface area of Dongting Lake and Poyang Lake has shrunk by three-quarters since June.

Sichuan electricity shortage

With a population of more than 80 million, Sichuan is one of the most populous provinces in China and an important industrial base. Nearly 80% of the local electricity supply originally came from hydropower, and the local summer rainfall was very abundant in previous years.

But Chinese media reported that some of the province’s main hydropower plants have bottomed out due to the high temperature and drought this year, with the province’s hydropower generation capacity down by more than 50 percent. At the same time, high temperatures have led to a surge in electricity consumption.

Authorities first restricted industrial power use, and many large manufacturers said production was affected by the curbs. China Business News reported that Sichuan is one of the important production bases for China’s display panel industry. Previously, continuous power outages had caused related industries to maintain low-productivity operations.

German carmaker Volkswagen told the BBC that its factory in Chengdu, Sichuan, remained closed.

Apple supplier Foxconn also closed its factory in Sichuan. Meanwhile, Japanese auto giant Toyota is gradually resuming production in Sichuan “using in-house power generation”.

What impact might this round of power curtailment measures have on the industry?

Compared with the wide range of power curtailment last year, only Sichuan has issued a power curtailment order. From August 15th to August 20th, 19 cities (prefectures) in the province (except Panzhihua and Liangshan) have ordered the Sichuan power grid. All industrial power users (including whitelisted key guarantee enterprises) in the power consumption plan will stop production. Combined with the industrial structure of Sichuan and Chongqing and the proportion of national output, power curtailment may have the following impacts:

(1) Lithium salt

The contradiction between supply and demand has further intensified, and prices have begun to rise slightly. According to SMM statistics, this round of power cuts is expected to lead to a reduction of 1,120 tons of lithium carbonate, 1,690 tons of lithium hydroxide, 500 tons of ternary materials, 52 million yuan/ton of lithium iron phosphate, and about 300 tons of graphitization output in August, accounting for about 300 tons in the industry. The proportions are 3%, 8%, 1% and 5%, respectively. The current tight supply and demand pattern of lithium salts will further intensify. In addition, the demand side is gradually entering the peak season, and various factors have boosted the price of lithium salts to further rise. Lithium carbonate has begun to rise slightly in recent days, and the quotation was 479,000/ton on August 19, an increase of 3,000 yuan/ton from August 15.

(2) Photovoltaic

Short-term supply is under pressure, and prices are supported. For the photovoltaic industry and industrial silicon, according to SMM data, the effective production capacity of Sichuan metal silicon accounts for about 16% of the country’s total production capacity. In July, Sichuan metal silicon production accounted for 21% of the country’s total supply. The power cut is expected to last for a week, affecting Sichuan’s silicon metal output of around 12,000 tons in August. At present, silicon metal has begun to rise but not by much.

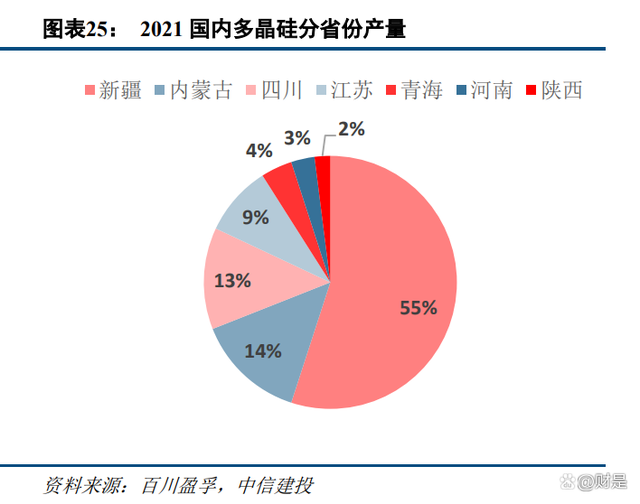

The production of silicon materials was suspended, and the ramp-up of production capacity was affected. In terms of polysilicon, in 2021, the polysilicon production in Sichuan will account for about 13% of the national output, making it the third largest producing area in the country. As polysilicon production enterprises go from shutdown to resumption of work, from load reduction to full load, the output will be affected for at least 10-15 days. It is expected that the impact on the supply of silicon materials will be slightly larger. The Silicon Industry Branch predicts that domestic polysilicon production in August will Expectations were cut by 8%. Coupled with the fact that some silicon material companies have oversubscribed orders until September, which led to the intensification of the shortage of supply in August, the adjustment time of market supply and demand relations in various links of the industrial chain in September will also be delayed. In the short term, the price of silicon material is expected to rise slightly.

The supply of silicon wafers and cells will also be under pressure in the short term. In terms of silicon wafers, according to SMM data, the affected companies are mainly Sichuan Leshan Jingke, Sichuan Leshan Jingyuntong, Sichuan Tongwei, with annual production capacities of 5GW/year, 12GW/year and 15GW/year respectively. For cell companies, the biggest influence is the leading company Tongwei. Currently, Tongwei cell has cell production lines in Meishan, Shuangliu, Jintang, etc. According to SMM data, the total annual production capacity is about 65GW/year. In addition, Yingfa’s production line of about 10GW/year is also affected to a certain extent.

(3) Chemical industry

Supply is tight, pay attention to power outage time. Sichuan is the concentrated production capacity of industrial chains such as phosphorus chemical industry and energy chemical industry, and the output of chemical products such as titanium dioxide and fertilizer accounts for a large proportion in the country. From the perspective of production capacity, the phosphorus chemical industry chain such as titanium dioxide and glyphosate may be greatly affected. For example, titanium dioxide has recently rebounded. On August 16, Sichuan Panzhihua Titanium Technology Co., Ltd. issued a price adjustment letter saying that in view of the current high production cost of titanium dioxide and the current international titanium dioxide market conditions, it has decided to increase domestic customers of rutile titanium dioxide by 500 yuan/ton. International customers are increased by 80 US dollars / ton; domestic customers of anatase titanium dioxide are increased by 500 yuan / ton, and international customers are increased by 80 US dollars / ton. In the case of tight supply, prices are supported. If the blackout time is longer than expected, the scope of influence may be greatly increased.

(4) Semiconductors

Semiconductor influence is limited. Sichuan Province is the highland of my country’s science and technology industry, and has initially formed a complete integrated circuit industry chain including IC design, wafer manufacturing, packaging and testing and other links. According to data from the Sichuan Provincial Development and Reform Commission, in 2021, the operating income of Sichuan’s high-tech industries will reach 2.1 trillion yuan. The announcement shows that BOE A will carry out routine equipment maintenance for the TFT-LCD production line in a timely manner during the power cut. The Financial Associated Press reported that Foxconn’s Chengdu factory also confirmed a power outage. However, due to the short duration of the power outage, the impact is expected to be limited. In addition, some companies have adopted preparatory plans such as off-site support or inventory, rushing to work on night shifts after recovery, and reducing production to ensure shipments.

To sum up, the impact of this power curtailment is currently concentrated in Sichuan Province, which is smaller than last year. Whether it will spread to other provinces in the future remains to be seen. At present, this power cut may have an impact on lithium salts, photovoltaics, chemicals, and semiconductors. (1) In terms of lithium salt, the contradiction between supply and demand will be further intensified, and it is expected that lithium salt will rise slightly if the downstream demand does not decrease; (2) In terms of photovoltaics, the supply of silicon materials, silicon wafers and cells will be affected, and the downstream demand will be strong. , the price is expected to rise slightly; (3) In the chemical industry, focus on the more affected industries such as phosphorus chemical industry and titanium dioxide, and the price may fluctuate in the short term; (4) In the semiconductor industry, pay attention to the follow-up time for power curtailment. It will not expand. If the power limit is upgraded beyond expectations, it is expected that the price of electronic components will be affected.